We Serve House Flipping Investors In Minneapolis MN!

(515) 238-9266 Book Us Now

House Flipping Investors Services

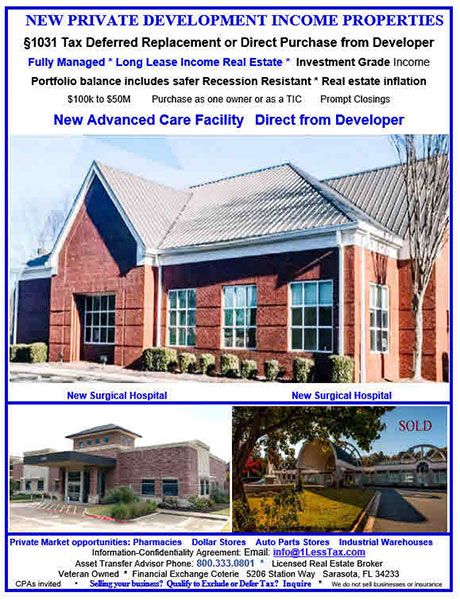

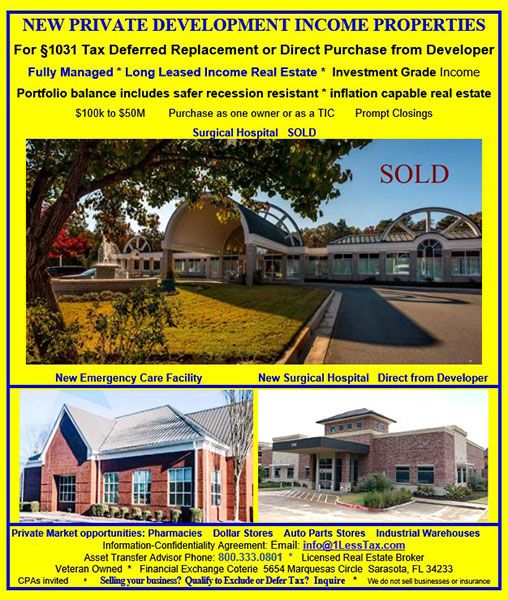

The best house flipping private investors often search for tax deferred exchange companies for help in avoiding capital gains taxes. If you are one of those top house flipping investors, know that Financial Exchange Coterie is the best tax deferred exchange company in Minneapolis MN. Since 2013, we have been providing legal 1031 exchange services and legal 721 exchange services of the finest quality. Call us and experience why our 721 and 1031 replacement properties company is better than other 721 and 1031 tax deferred property companies in town!

1045 Exchange Service

Are you hunting for tax specialists who specialize in 1045 exchanges? You are really fortunate to have found this page! The state grants us a tax deferral under Section 1045 of the United States Code when we sell qualifying small business stock (QSBS) for other QSBS. If you are considering selling small business stock to invest in something else, we may be able to save you money by providing legal 1045 exchange services. Our free consultations can aid you in establishing whether or not your stock qualifies. Have you decided to make use of our services? Make contact with us and prepare to be amazed!

Replacement Property 1031 Services

Replacement property 1031 exchange services from reliable 1031 replacement properties companies are ideal for house flipping investors who want to save on taxes. Working for a business that is known as the best legal replacement property 1031 company operating in Minneapolis MN, we will get you completely legal 1031 exchange tax deferrals. If you have decided on replacing a property with another, know that our extensive experience and knowledge make us the obvious choice for tax deferred exchange services. Call our 1031 tax deferred property company for more details!

Our 1031FEC Features:

How we maintained our status as a top-notch company:

- Institutional Quality 1031 Exchange Properties

- New Tax Deferred Investments

- Simplified 1031 Exchange Solutions

- Quick Closings

- Deeded Property

- Recession Resistant

- Low Minimum Investment $100,000 Minimum

- Professional Management In Place

- Single-Tenant Long Absolute Leases

Benefits Of A 1031FEC Exchange:

1031FEC Exchanges are a core component of 1031FEC’s innovative tax reduction approach. A 1031 exchange may allow you to defer gains from the sale of real property to a more opportune time. You may be able to diversify your portfolio by geography, type of investment, and industry while still matching debt/equity requirements of the code by exchanging into a professionally managed 1031FEC property. With 1031FEC Exchange, you receive passive income without management responsibility, that’s retirement. Some benefits of a 1031 Exchange include, but are not limited to

- Income paid monthly

- Recession resistant commercial income property available nationally

- Help to reduce the stress of mandated 45 and 180 day 1031 Exchange deadlines.

- The ability to partially shelter income through proportional participation in interest deductions and property depreciation.

- No day-to-day management. Professional property and asset management in place

- National single-tenant renters with long leases.

- Ability to utilize IRC 1031 again in the future upon disposition of current fractional or fully deeded real property investment.

- Other tax deferral and tax exclusions for businesses and property by IRS code

- Veteran owned business

Financial Exchange Coterie – a locally owned and operated company - has provided top-notch legal tax deferred exchange services to house flipping investors since its inception in 2013. Our owner, Ken Wheeler, is an FL Real Estate Broker and has four decades of tax-efficiency experience. We only hire certified professionals to ensure quality as well as confidentiality for our clients in Minneapolis MN. Our real estate property management experts will not disappoint you in the provision of tax shelter in real estate. You can call us for exchange deferred services like 1031, 1045, 1033, and 721 exchange services. Get in touch!

Find Us